We are happy to introduce a new category of simulations for fundamental equity investment analysis. This subject is a combination of balance sheet analysis, valuation, observing market price behavior, grasping company business models, forecasting and also psychology. We have been getting a number of queries to develop simulations based training module for investment analysis. We thought the best way to address this need is to build case studies from Indian markets and ask users to take investment decisions.

Curriculum mapping: We offer 140 simulations across 10 important finance subjects. Our complete set of skill simulations mapped as per AICTE Course Curriculum subjects can be found Here and the demo of the structure and content of the simulations can be found here. For further information, please write to us at founder@equitylevers.com

Real problems in Investment Analysis

We have developed 14 investment analysis case studies from Indian capital markets that show case a variety of investment analysis themes that help learn about peculiarities of financial analysis and investing:

Is high margin always good ?

Cause and Effect - Noticing events that will have outsized impact of stock prices

Finding companies in sweet spot – Analyzing strong growth in financial data, noticing its key reasons and taking advantage of the same

Learning to assess dividend stories

Identifying balance sheet issues in companies and avoiding investing in such companies

About companies that raise too much capital

Is high PE valuation really expensive?

and more..

The simulations are designed in excel as investment notes developed by a financial advisor and the learner has to take decisions to buy/ sell or hold and answer upto 4 MCQ questions. We have covered stories from CDSL Ltd, MRF, Just Dial, Apollo Tricot, AIA Engineering, RBL Bank, Tata Motors, among others. In the answers to the simulations we explain what the investment story was with real name of the company and how it played out. This is suitable for beginners and advanced users with basic knowledge of finance and common sense.

The projects are engaging amongst students and feedback is very strong.

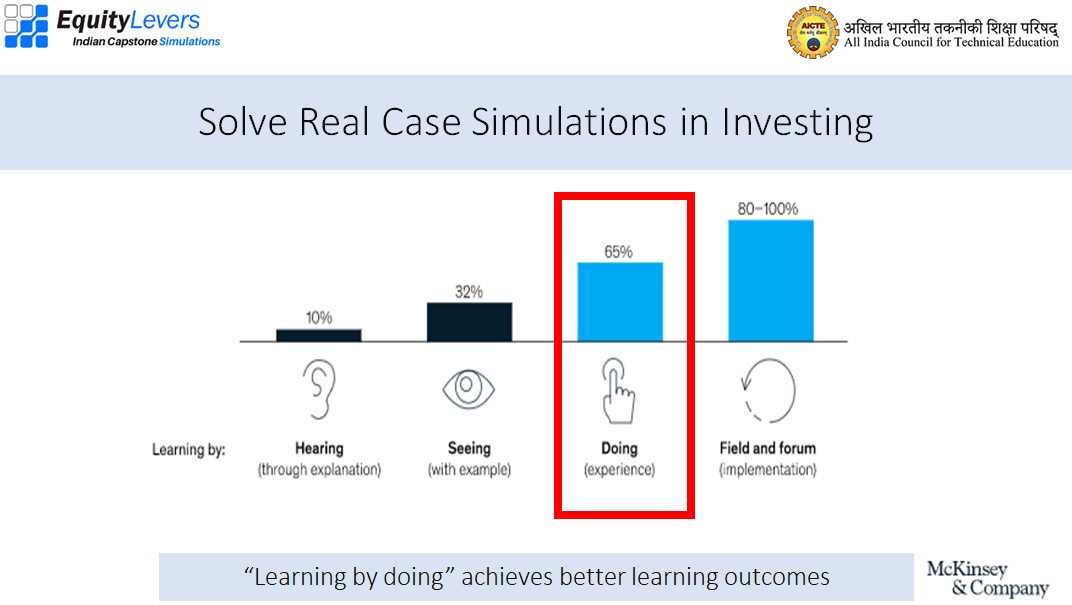

“Why solve projects and not just listen to videos”

While, we could have just written the story or created a video, but we have designed this as simulations so that each student can be deeply involved in the case and solve. Solving a case has better learning outcome. The simulations comes with scoring features and can be used as exams also.

A brief overview of select cases :

This is an example of how some watershed events can turn into opportunities for companies. Following 40% correction in the Indian stock markets owing to the pandemic, retail participation in markets exploded and almost 1cr Demat accounts were opened between Jan-20 to Jan-21. The major beneficiary of the spurt in ‘Robinhood’ investors was this company. The phenomenal earnings growth caused the stock price to grow 4X in just 9 months.

A home-grown search engine witnessed a strong growth phase from 2012-2016 wherein it commanded a high P/E multiple ranging between 55-80X. As Google started gaining stronghold in Indian markets, prospects of this company started to weaken 2016 onwards. Emergence of niche players like Ola, Practo & Zomato further impacted its earnings growth.

This case explains how introduction of novel product lines drives the top-line and bottom-line growth of a company. This company invested massively in production facilities of special products in FY18 & FY19 which boosted its revenues by 100 times between FY19-21. The stock price rose by almost 4.5X in last 2 years.

This is a classic case of how dismal topline & bottom growth causes the stock prices to remain in a status quo. This company witnessed anemic growth in the last 2 years which was partly caused due to the pandemic as well. The stock prices have remained in a range due to this reason.

This Bank pursued an aggressive growth strategy in the risky segments like microfinance, credit cards & personal loans since 2010. This growth was achieved through repeated fund-raising. Both these attributes are risky from an investor’s point of view. Once the stress emerged the loan book owing to an economic slowdown, its net worth got impacted & stock price fell from to 1/4th form its peak

This is a classic case wherein there was an anomaly between the P/E & P/S multiples for this company. While the sales grew at a dismal 4% YoY, earnings fell drastically on back of commodity inflation, price wars in China & Brexit. Stock price followed suit & fell from Rs. 500 to Rs. 200 levels in 4 years causing P/E to rise sharply & P/S to drop considerably. Hence P/E metric was not the logical valuation tool here owing to weak earnings growth.

This is a case of a typical Indian public utility company which has a defined ROE for its contracts & distributes majority of earnings to shareholders. This company has a history of high dividend pay-outs & dividend yields of 7 to 8% p.a. As a result of high pay-outs, the company reinvests little in future growth opportunities. The stock price generally remains range bound owing to weak earnings growth.

This company declared a whopping 20000% (on face value) dividend for the shareholders in 2020. After pay-out, the stock price got re-adjusted & fell to Rs.12 from Rs.1000 as of the ex-date. It would have been prudent for investors to steer clear of taking a long position in this Co. & for existing holders to sell their stake before the ex-date from the income tax perspective, a key investment driver.

Where to find the simulations :

About EquityLevers: We are AICTE approved.

“Learning by doing” has been scientifically proven as the best way to learn any subject or skill whatsoever. We at EquityLevers strongly believe that mastering financial concepts is very much like learning to play cricket or learning to dance -- the more time one would spend in solving real-life problems, the deeper would be his/her understanding. EquityLevers offers 140 basic to advanced finance skill projects in Excel across 10 major finance subjects including Investor Education, Personal Finance, Accounting, Financial Analysis, Corporate Finance, Bond and Fixed Income Markets, Valuation and Modelling Mutual Funds and Wealth Management, Managerial Accounting, Finance for Marketing and Operations Managers, Derivatives and Risk Management. The projects are set in Indian context with real-time data from companies to help prepare for job roles in investing, accounting, treasury, trading, wealth management and so on. Each learner gets personalized real data set to solve in most of the 125 skill simulations.

Thank you for reading.