We have been investors in equity markets for past 10 years and have generated very strong returns over this period. Most of our investments are based on financial analysis on market patterns that work. We have developed algorithms that track market patterns to help organize ideas, particularly among less tracked small and mid cap companies. This Finance Lab is based on our algorithm and learnings from market patterns that work.

Companies that report strong and trend beating performance typically have a higher chance of continuing better performance over the next periods. Lets understand why this happens. Lets say you just passed the IAS or IIT exam. You would be in a sweet spot of great opportunity as you reputation and income can be expected to increase sharply over next few years. Similarly, if a business is in good economic situation due to certain policy changes or consumer preferences, its quarterly financial data will show this. This trend can continue for many months and often years.

The algorithm tracks 2000 companies each time a new result (over 40 quarters) is announced. Over past 10 years, about 6000 ideas were identified by the system as potentially good/buy companies and ~10,000 as potentially avoid companies. Out of the ~6000 companies ‘Potentially Good’ companies, based on back test basis, 53% of these companies went on to give returns of more than 20% within one year and 44% of these 53% companies, proved to be Multibagger within 1 year of investment. This list has also been a good pointer for the prevailing and upcoming economic situation. Bull markets being associated with more companies delivering strong performance in the period.

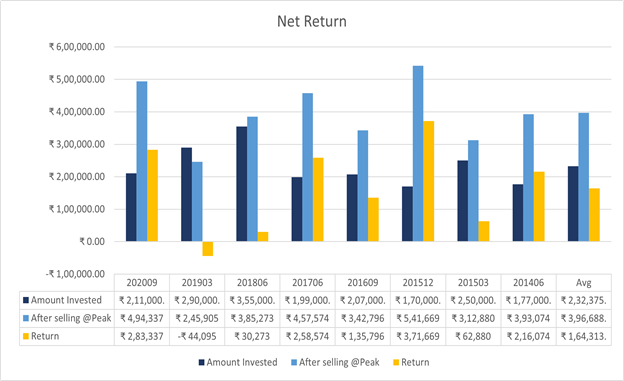

Back Test Returns

Here is a returns chart for select past periods (quarter end dates). Returns computed on Rs 1000 invested in every “Potential Buy” idea. Please note that returns were computed by selling at highest price in the next 12 months. Please note that this system works most of the time but not always - please see loss in 2019-03. We do further work before investing and accordingly encourage our users to similarly do further evaluation and take own independent decisions.

Disclaimer

We have opened this algo list as an education tool - a good shortlist to start further work. We do not take any responsibility for losses. We disclose that we may be investors in these companies. These are not recommendations but output from our financial analysis algorithm. We are not sebi registered advisors.